Step Up to Recovery walk

5km Walk in Aid of Kyrie Therapeutic Farm

Supporting Mental Health Recovery in Ireland.

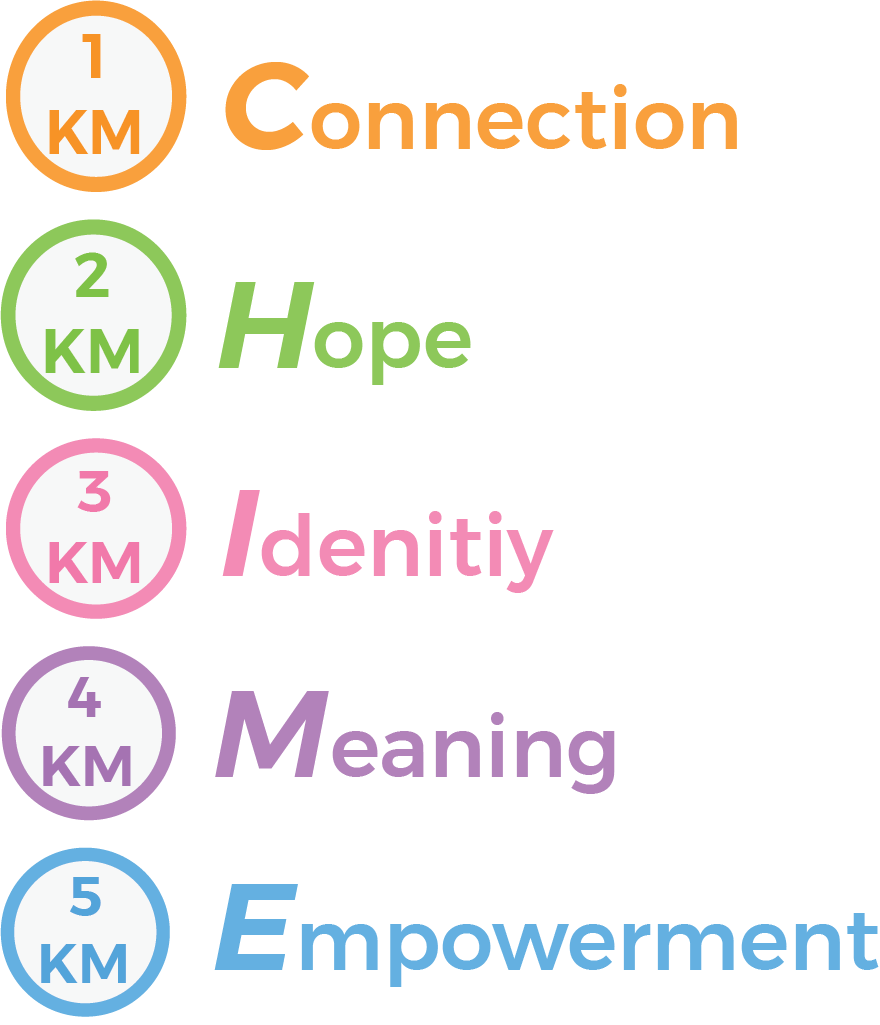

Each km represents a part of the CHIME framework:

Connection, Hope, Identity, Meaning, and Empowerment.

Take a mindful moment to refl ect on what each word means to you.

This framework supports people facing mental health challenges to live to their fullest potential.

All proceeds going directly to Kyrie Farm.

Register today and consider raising funds to help Kyrie Farm build Ireland’s first dedicated residential step-down farm for people recovering from serious mental health challenges.

| FUNDING REQUIREMENTS | €m |

|---|---|

| Farm | 1.5 |

| Buildings | 2.5 |

| Equipment & Establishment | 1.0 |

| Start Up Costs * | 1.6 |

| Total Funding | 6.6 |

* €1.6m Start-Up Costs includes:

- Recruitment of the clinical lead for service definition and development, to secure appropriate approvals and partnerships.

- Recruitment and training the team prior to start-up.

- Provision of working capital shortfall for the first year while staffing and build up of guests come into balance and training takes place.

- KTF day rates will be ~35% lower than psychiatric day rates resulting in a ~€80K saving per occupant per year for the HSE and private health insurers.

KTF day rates will be ~35% lower than psychiatric day rates resulting in a ~€80K saving per occupant per year for the HSE and private health insurers.

Financial Donations

We welcome donations from individuals and corporates to assist in the establishment of KTF. Between 2020 and 2023, the KTF has a funding requirement of €6.6m. The funding requirement includes:

- Acquisition of farm & land.

- Construction of buildings.

- Farm equipment & building fittings.

- Recruitment of clinical lead & team prior to being operational.

- Working capital shortfall in year one.

The initial funding requirement for 2020/2021 is for €4m by March 2021 to secure the acquisition of the farm and commence the process of planning and construction. The remaining €2.5m would be raised thereafter.

Financial donations can either be paid direct to the Non-profit Company by contacting John McKeon at Kyriefarm@gmail.com or by Mobile on 0872581485 or via the Donate button below

Outcome Evaluation

University Research

Kyrie Therapeutic Farm will be engaging with Universities to carry out continuous research on the benefits realized by guests of the farm.

The research will form an outcome evaluation and provide a level of quality control to the therapy provided. It will identify key learnings as to the most effective therapies and build on the already proven outcomes from the global community of Therapeutic Farms.

Get in Touch

Not for Profit

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.

Non Discriminatory

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book. It has survived not only five centuries, but also the leap into electronic typesetting, remaining essentially unchanged. It was popularised in the 1960s with the release of Letraset sheets containing Lorem Ipsum passages, and more recently with desktop publishing software like Aldus PageMaker including versions of Lorem Ipsum.